Vehicle Loan

A List of the Best Auto Refinance Companies to Consider

Dec 3, 2024

Choosing the best auto refinance companies can help your monthly budget and improve your financial health. If you want to reduce your financial burden or cut down interest rates, you're in the right spot. This guide helps you find top auto refinance companies today. We aim to provide insights on the best choices and show how to use an auto loan calculator for assessing refinancing options. Knowing auto refinance rates and how they affect your credit score is important. We will explain that too. Whether you are a first-time refinancer or seeking better options, our list guides you. Let’s look at how to refinance your car loan to free up cash and gain financial flexibility.

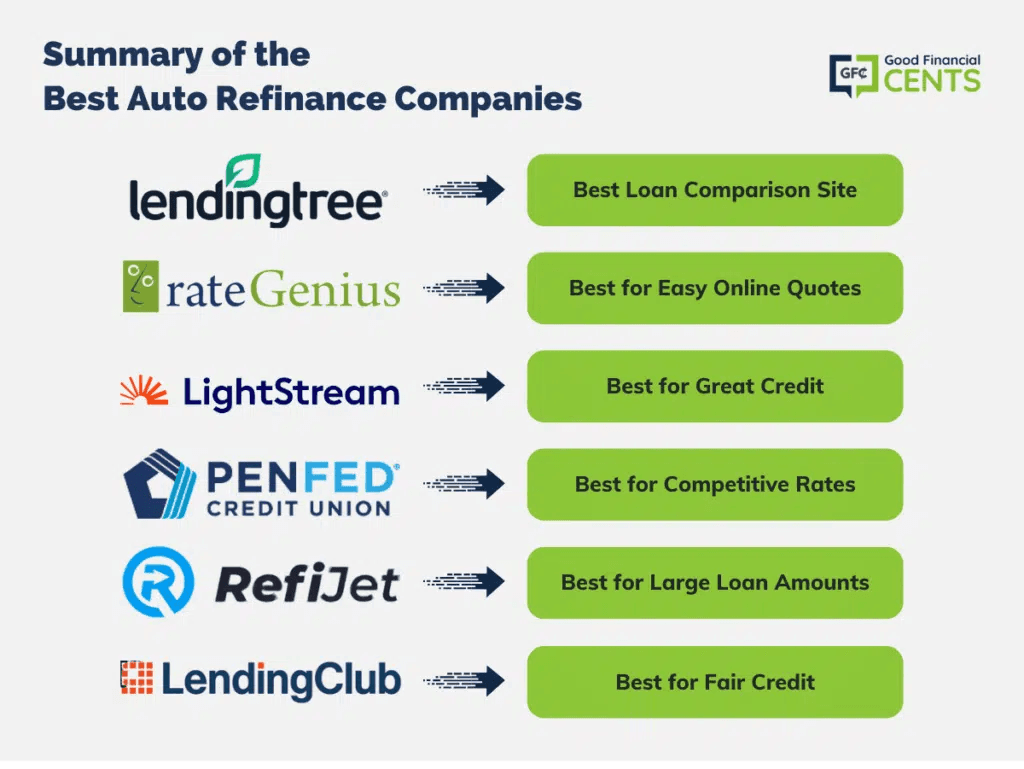

Top Auto Refinance Companies

Finding the best auto refinance companies can seem tough. Borrower profiles, customer ratings and loan offers make lenders stand out. Each company meets different needs, helping borrowers choose the best refinancing options for their own situations.

LightStream ranks among the top lenders in auto refinance. Known for competitive rates, it offers flexible terms. LightStream provides low APR rates for those with good credit. This can mean lower monthly payments. Their fast funding and easy application process are also highlights.

RateGenius offers a unique way to see multiple refinance offers. This helps borrowers compare rates and find the right fit for their finances. It's a great option for average credit borrowers. More chances mean better deals. Their system really helps in narrowing down choices.

Auto Approve is also a good pick, especially for those with less-than-perfect credits. They provide a streamlined process, customized solutions based on borrower profiles and competitive rates. They cater to different financial needs with focus and care.

It's important to understand various lenders and borrower profiles. For instance, higher credit scores usually result in lower rates. Lenders like LightStream, typically focus on these. But RateGenius serves a wider range of credit scores, giving more people options.

Customer experiences matter too. LightStream has great reviews for their service and user-friendly apps. RateGenius has earned praise for clear offers. Auto Approve stands out for their dedicated support through the refinance journey.

Being informed about lender differences aids in selecting the best auto refinance company for you. Using an auto loan calculator can help maximize savings when looking into refinancing options. It’s a smart way to calculate and sort your options.

How to Use an Auto Loan Calculator

An auto loan calculator is a must for those who think about refinancing their car loans. This tool helps users see different loan options. You can see what your monthly payments could be with different terms. Just enter current loan info and new loan details to see how refinancing affects your finances.

To use an auto loan calculator well, first enter your current loan amount, interest rate, and the remaining term. Next, add the new loan amount, interest rate, and term from the best auto refinance companies. It allows you to compare what you owe now with the potential new loan, which helps you decide to refinance.

One major perk of the auto loan calculator is the chance to see potential savings before you take a new loan. For example, refinancing can lower your monthly payments by about 1-3 percent, based on your credit and market factors. By checking these numbers, you can get an idea of how much you'd save and if the benefits are worth any fees.

In conclusion, getting skilled with an auto loan calculator helps you to make wiser refinancing choices. Grasping the details of your refinancing lets you review options from the best auto refinance companies, making sure you get the best terms for your finances.

Best Auto Refinance Options for Different Needs

When looking at auto loan refinancing, it's important to find lenders that fit specific financial needs. This overview offers insights into the best auto refinance companies categorized by credit scores, interest rates, and loan types available.

If you have bad credit, consider lenders like Carvana and Capital One. Capital One is known for understanding the struggles faced by people with low credit. They offer several refinancing options, which may enhance your chances of approval. Meanwhile, Carvana has an easy application process that helps in getting quick approvals.

Low rates may lead you to companies like Bank of America and LightStream. Competitively, LightStream has some lower rates, often starting at 3.49% APR for top borrowers. Bank of America is well-liked for good customer service and low average interest rates, making it a good choice for saving money over time.

Cash-out refinancing attracts those who want to use their vehicle's equity. Lenders such as MyAutoLoan include options for cash-out refinance, enabling borrowers to access funds for other expenses while enjoying lower interest rates. This versatility is important for managing other financial obligations.

Feedback from Ainee users shows satisfaction with these lenders regarding efficiency and service. Many consumers have reported substantial savings from lower interest rates, which helped lower their overall loan costs. Some even noted savings of about $100 monthly after refinancing, amounting to big savings over their loan duration.

Using an auto loan calculator assists in determining which lender meets your refinancing needs best. Inputting various rates and terms allows potential borrowers to project monthly payments and total refinancing costs, aiding in smart decisions.

Recognizing the best auto refinance companies for unique financial situations helps in gaining more stability and cutting down monthly costs. Next, we will explore Understanding Auto Refinance Rates to give you more tools to handle these options well.

Understanding Auto Refinance Rates

Auto refinance rates play a vital role in deciding to refinance an auto loan. Factors that affect these rates include credit scores, which are very important. Borrowers with good credit scores can access better refinance rates. For example, people with scores over 740 tend to get rates between 3% and 4%. Those with scores under 600 usually face rates starting around 10% or more.

Market conditions also affect auto refinance rates at late 2023. The average rate for an auto refinance is about 5.46%. However, this can change greatly based on lender offers. Some of the best auto refinance companies might offer rates as low as 3.25% for borrowers with strong credit. This could save money compared to current high loan rates. It is important to compare offers from different lenders since rates can vary.

Trends in automotive finance have shifted with the changing economy. More lenders compete, giving potential borrowers chances to refinance at lower rates. Actually, an increase in refinance applications shows consumers are taking advantage of good rates. Now can be a good time to look at options, especially if your loan rate is above the average today.

An auto loan calculator can help when thinking of refinancing. It lets borrowers predict savings, compare new loan terms, and calculate monthly payments for different rates and amounts. This tool helps in picking the best auto refinance companies matching your money goals.

As we move to the next part, keep in mind that knowing about auto refinance rates is key to refinancing an auto loan successfully.

How to Refinance Your Auto Loan

Refinancing your auto loan is important financial move. It can help you get better terms, you can reduce payments. The refinancing process is simple, but it involves steps to make an informed choice. Here’s a guide that explains how to effectively refinance your auto loan.

1. Check Your Credit Score: Assess your credit score first. Most lenders give better rates to folks with high scores. A current credit report from major bureaus will help you see what to expect. A score above 700 is good. A score above 740 often gets the best rates around.

2. Research the Best Auto Refinance Companies: After knowing your credit score, look into different lenders and their products. Compare rates, terms, and customer feedback, to find the best auto refinance companies for your situation. An auto loan calculator will show you potential savings if you refinance.

3. Prepare Your Documentation: Collect essential documents, like current loan details, ID, income proof, and vehicle info. Keeping your documents organized will speed up the process and help lenders provide precise rates. This will make the entire loan process easier.

4. Apply for Pre-Approval: Many lenders will pre-approve you before the loan finalization. This helps you get an idea of what rates apply to you without risking your credit score. Apply to several lenders to find the best deals out there.

5. Negotiate Terms: Don't hesitate to negotiate your loan terms. If one lender offers a lower rate, mention it to others. Often, lenders will adjust their offers to win your business. This could lead to better deals.

6. Choose the Right Offer: After you receive offers, analyze them closely. It’s key to consider not only the interest rate but also any fees or the loan term involved. A smaller payment might not be a better deal if it takes longer to repay and leads to more interest.

7. Finalize the Loan: Once you pick your lender, it’s time to finalize the details. Make sure to clear terms before signing anything. Reviewing the contract thoroughly can help you avoid future surprises.

Refinancing can offer benefits like lower payments or total interest savings. But it's key to recognize risks with refinancing. Early payoff penalties on current loans can be costly. Extending the loan term may mean more overall interest costs, which is crucial to factor into your plans.

In conclusion, refinancing your auto loan can lead to savings. By tracking credit scores, doing thorough research on loan options, and reviewing documents, anyone can navigate this process successfully and find the best auto refinance companies.

With understanding the refinancing process, now let's look at when the best times to refinance your car loan for the best results.

When to Refinance Your Car Loan

Refinancing your car loan saves money and helps your financial situation. It’s important to know when to refinance. Many life changes and market conditions signal when you should look into refinancing. An improvement in your credit score is a key indicator. If you’ve raised your credit since getting your loan, you may now qualify for better interest rates, maybe lower monthly payments or less overall costs.

Consider the market's current interest rate too. If rates have dropped since your original loan, this may a excellent opportunity. A drop of just 0.5% to 1% can save you a lot of money over time, improving your financial state.

Changes in your personal situation matter. An increase in income or unexpected expenses shape your refinancing decision. Recently getting a raise or paying off high-interest debts suggest refinancing could ease monthly payments and help your budget.

Using an auto loan calculator helps to find the best refinancing options. You can enter your current loan terms and new rates to see potential long-term savings, considering benefits vs costs of refinancing.

Ainee can assist you to evaluate your finances and find the timing to refinance. They offer expert advice and tools that make sure you make educated choices.

Timing refinancing right is key to getting the best from your auto loan. While considering refinancing, remember it might affect your credit score. In the next section, we will dive into how refinancing can influence your score and how to lessen negative impacts.

The Impact of Refinancing on Your Credit Score

Refinancing an auto loan can impact your credit score in different ways. When you apply for a new loan, it may cause a small drop. Hard inquiries can lower your score by 5 to 10 points. This drop is temporary. It stabilizes after a few months if you manage your credit well.

Over time, the best auto refinance companies can help improve your credit score. If you refinance for a lower rate, you can gain a stronger financial position. This can lead to timely payments, which helps credit history. Payment history is very important and makes up 35% of your score. Making your payments on time can increase your credit standing.

Refinancing also helps lower your debt-to-income ratio by reducing monthly expenses. Lenders look at this when they check your creditworthiness. A lower ratio may help you secure future credit, making your score better.

To keep credit healthy while refinancing, it’s smart to leave existing accounts open. Closing old accounts lowers average account age. This age affects 15% of your score. Avoid late payments on existing debts while considering refinance options. Missed payments affect your score.

In short, refinancing an auto loan can affect your credit score at first. But, the long-term benefits of lower payments and better payment history can outweigh the setbacks. Responsible financial habits during this time will help protect your credit health.

Conclusion

In brief, finding the best auto refinance companies can change your finances by reducing monthly payments and interest rates. This article shows top auto refinance options that fit different needs. It also covers how to use an auto loan calculator and the best time to refinance your vehicle loan. Each piece of advice helps in making informed choices.

Now that you understand the best auto refinance options and tools available, take the next step. Check your present auto loan, and use an auto loan calculator to weigh offers. Contact some best auto refinance companies we mentioned. These steps help improve your financial situation.

Don't forget, refinancing could lessen financial strain and might enhance your credit rating if done carefully. Make the most of this chance for better money management!

About Ainee

Ainee is a personal financial advisory platform that specializes in refinancing solutions for mortgages and vehicle loans, offering users personalized guidance and insights into their financial decisions.

It matters because Ainee helps individuals save money on loan payments by presenting tailored refinancing options that connect them with lower interest rates and expert advice. Start your journey towards smarter financial decisions by downloading the Ainee App today!