Vehicle Loan

Financial Advisor

How to Explore Your Refinance Loan Options for Maximum Savings

Dec 5, 2024

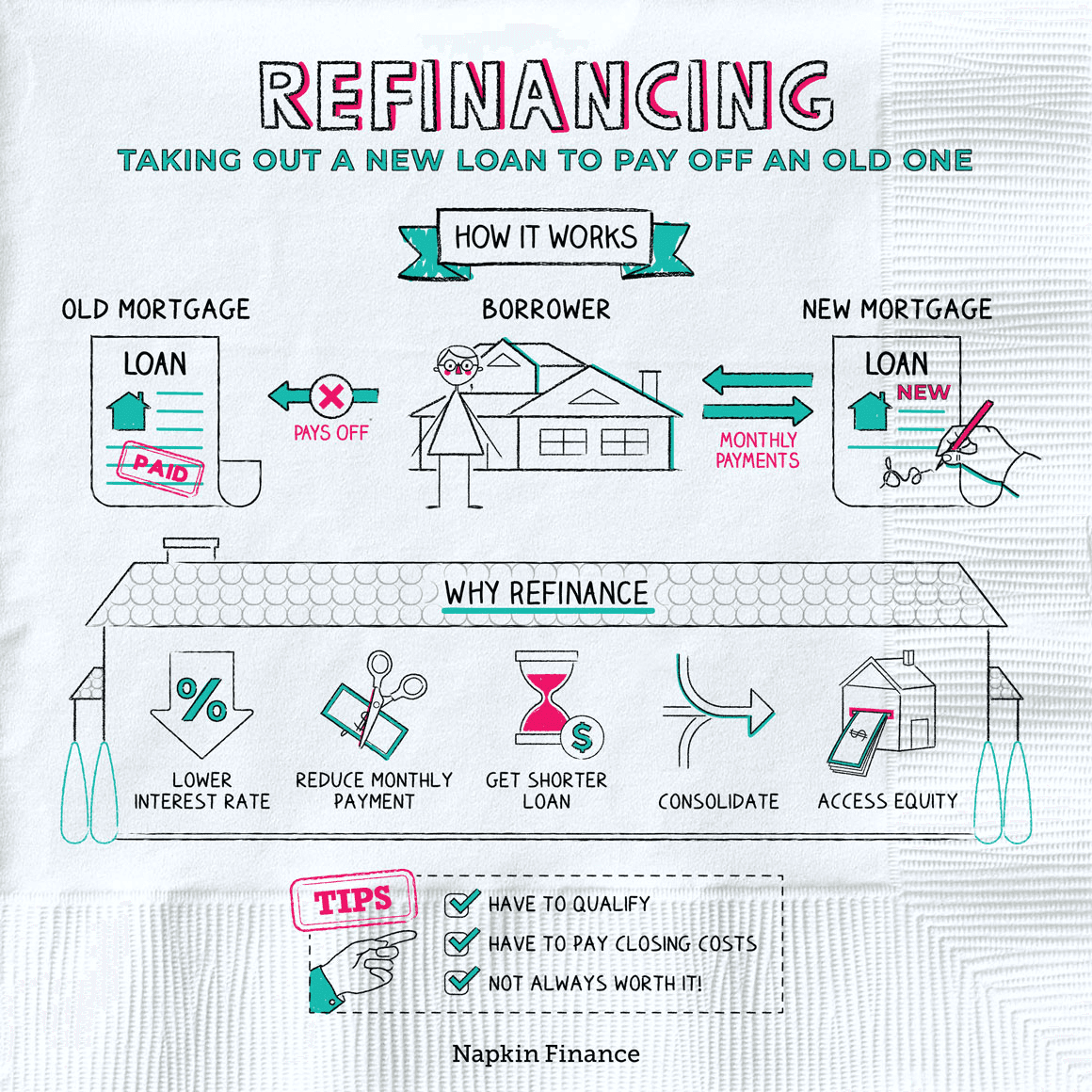

Are you seeking ways to get the most from your savings by exploring refinance loan options? The process of refinancing your mortgage may seem complex but it doesn’t need to be hard. Interest rates change, and goals shift, so knowing your refinance loan options helps you make decisions to save big.

This guide will explain the various types of refinance loans and their benefits. You’ll learn how to locate the best refinance rates, keeping what you need at the forefront. We also will discuss eligibility criteria, costs tied to refinancing, and the procedures involved to help you dodge common slip-ups.

Whether you are a newbie homeowner or adjusting your financial plan, this guide will help you look at your refinance options confidently. You can maximize your refinancing strategies in this ever-changing mortgage environment.

Types of Refinance Loans

When exploring refinance loan options, knowing the different types that target your financial needs is key. Each variety of refinance loan has purpose specific to your situation.

The most popular refinance loan options are:

Rate-and-Term Refinance: This choice lets homeowners replace a current mortgage with a new one, featuring different terms like lower rates. Homeowners often use this method to decrease monthly cost through cheaper rates.

Cash-Out Refinance: This replaces an existing mortgage with a bigger loan. You can access your equity this way. If your house is $300,000 and you owe $200,000, you might refinance for $250,000. This lets you take $50,000 cash for things like renovations.

Streamline Refinance: This option is made for FHA, VA, or USDA loans. It simplifies the refinancing steps. It normally needs less paperwork and no home appraisal. This option speeds up the process.

No-Closing Cost Refinance: This lets you refinance without upfront closing costs. These costs can roll into the new loan agreement. Keep in mind your overall interest might increase.

Grasping these refinance loan options is very important. This helps in making smart choices that may result in savings. Careful review of your finances helps find which option matches your financial aims.

Next, we’ll look at the perks of refinancing. This info will help you see if these refinance loan options suit improving your finances.

Benefits of Refinance Loan Options

Refinance loan options come with many benefits that can help your finances. One big advantage is lower monthly payments due to decreased interest rates. When rates decline, homeowners might find that refinancing gets them a better rate than they had before, which leads to real savings over time.

Another benefit includes getting rid of Private Mortgage Insurance, or PMI. If you first financed with less than 20% equity, paying PMI was necessary. But if your equity is above 20% from market growth or paying down the mortgage, you can remove PMI by refinancing. This will also lower your monthly expenses.

Finally, these refinance loan options allow access to the equity in your home. Home equity can be useful for making renovations, paying off debts, or managing major expenses like education. A cash-out refinance lets homeowners use their home equity for other projects while getting better loan terms.

In conclusion, refinance loan options can result in lower payments thanks to reduced interest rates, dropping PMI, and accessing equity for finances. These points all add up to big savings, which makes this choice appealing for many people.

After recognizing the benefits of refinance loan options, finding the best refinance rates should be the next step to maximize savings.

Finding the Best Refinance Rate

Finding the best refinance rate matters. It affects your monthly payments and borrowing costs. To save more, consider different refinance loan options and take some strategic steps.

Improve your credit score to qualify for lower refinance rates. Lenders like borrowers with higher scores; they see them as less of a risk. Even a small score jump might reduce your mortgage rate by 0.25% or 0.50%, leading to huge savings over time.

It's important to shop around and compare refinance loan options from different lenders. Rates can differ a lot, sometimes by 0.50% or more. Gather quotes from at least three lenders. This helps you understand the rates and terms available. Don’t forget to check fees too, as these can change total costs greatly.

Another method to score a better refinance rate is paying points. Points are fees paid upfront to lower your rate. One point costs 1% of the loan amount and cuts your rate by about 0.25%. This choice works well if you plan to stay in your home for many years, allowing you to save on payments.

Timing your refinance application is also important. Rates go up and down based on economic factors, including the Federal Reserve's actions. Watch trends to find the best moment to lock in a rate.

Researching your refinance loan options leads you to the best refinance rate. With the right approach, refinancing can mean big savings and better terms overall.

Next, understand what it takes to qualify for refinancing. Knowing the requirements helps you get ready to explore options and find savings.

Eligibility Criteria for Refinancing

Grasping the eligibility criteria for refinancing is vital for maximizing your refinance loan options. A primary requirement includes your credit score. Most lenders like borrowers with a score of 620 or higher for conventional loans, while some backed by the government may relax this. Still, having a high score usually brings better terms and lower rates, making a good credit history important.

Besides credit scores, home equity matters during refinancing. Homeowners should have roughly 20% equity in their property to qualify for better refinance loan options. Lenders look at this equity to make decisions since it reduces their risk. When your home value exceeds the mortgage by this amount, it shows financial stability.

A key aspect is the debt-to-income (DTI) ratio. This ratio looks at the portion of your income used for debt repayment. Lenders generally prefer a DTI under 43%, though exceptions exist for some cases. A lower DTI means better debt management skills, making you a preferable candidate for refinancing.

In conclusion, borrowers should have solid credit scores, enough home equity, ideally over 20%, along with a good DTI ratio to qualify for refinancing. Satisfying these guidelines boosts approval chances and can lead to notable savings on interest rates and monthly payment.

As you review your eligibility, we should now dive into the essential topic: understanding the different costs and considerations linked to refinancing.

Costs and Considerations for Refinancing

When you look at refinance loan options, it is important to know what costs are. Average closing costs range from 2% to 6% of the loan amount. These costs can affect the potential savings, so comparing these numbers to the refinancing benefits is essential.

Some homeowners might look into a no-cost refinance. It looks great at first, but it often comes with higher long-term interest rates. Those rates can cancel out the savings that seem appealing. So, weighing the benefits and downsides of such refinancing is important.

Calculating the break-even point is another key element. This is when savings from a lower monthly payment are more than the refinancing costs. Knowing when you start to gain back your closing costs is key to choosing wisely on refinancing options.

In the end, the effects of refinancing can depend on each person's situation. It's important to check all costs, compare different refinance loan options and find possible savings for better financial decisions.

Now that the costs and considerations of refinancing are clear, the next focus should be understanding the refinancing process and managing it effectively.

Refinancing Process Steps

Understanding the refinancing process helps with informed decisions that lead to savings. It’s crucial to have refinancing goals, like lowering monthly payments, shortening the loan term, or accessing cash for other needs.

Here are the steps to navigate refinancing process effectively:

Set clear refinancing goals: Know why you want to refinance. Aim to lower monthly payments, reduce overall interest by shortening term, or access equity through cash-out refinancing. Specific goals direct your actions during process.

Shop for the best refinance rates: Comparing lenders is key. Rates vary much among lenders. Take time and explore multiple refinance loan options to find best suited rate for your financial needs. Just a tiny difference in rates can produce big savings over loan.

Complete the application and required paperwork: After choosing a lender and loan option that fits needs, you need fill out application. Gather documents like proof of income, credit history, and existing mortgage info. This part needs thorough examination. It’s key for securing new loan.

Following these steps gives a structured approach to refining refinance loan options, leading to better financial outcomes. After refinancing, avoid common mistakes that many borrowers face.

Common Mistakes to Avoid When Refinancing

Refinancing offers a good chance for homeowners wanting to lower payments or tap into home equity. It’s vital to move through the process carefully. Watch out for mistakes that can hurt the benefits from refinance loan options. This section covers errors to sidestep.

One big error borrowers make is not looking for the best rate. Financial experts noted the difference in rates between lenders can be huge. If borrowers don’t compare lenders, they might miss a better rate, leading to higher monthly costs or extra costs during the loan's life. As a best practice, borrowers need at least three quotes from different lenders for the best deal.

Another key error is ignoring the total costs of refinancing. Borrowers often only think about the new rate and monthly payment, overlooking closing costs, fees, and other expenses tied to the process. Refinancing can come with costs like appraisal fees, title insurance, and origination fees, all adding up quickly. It's important to determine if the lower rate savings will outweigh these costs over time.

Also, not understanding how refinancing affects long-term financial plans can cause regret. Refinancing for a lower rate might bring immediate savings but can increase the loan length, raising overall interest payments. Borrowers must evaluate how refinancing fits into their goals, whether saving for the long haul, clearing debts faster, or getting ready for investments down the road. Making sure refinancing works with your financial strategy is key for getting the most benefits.

By steering clear of these mistakes, you'll make smarter decisions about your refinance loan options, paving the way for improved financial results.

As you think over these points, consider rummaging through Ainee's personalized refinancing solutions to simplify the process.

Ainee's Personalized Refinancing Solutions

Ainee understands each financial journey is unique. Therefore, we offer personalized refinancing solutions adaptable to your needs. Whether it's mortgage or vehicle loan, our expert advisors help you explore options for the best refinance loan options.

Our method starts with a deep analysis of your current finances. By assessing your income, credit score and your goals, we offer tailored refinancing advice that aims to maximize your savings. This strategy can lead to lower monthly payments, friendly interest rates, and better loan terms, helping you achieve good outcomes.

Ainee connects you with financial experts who understand refinancing. Their knowledge helps you through complex lender options ensuring you make wise choices. With expert support, you will navigate refinancing smoothly and efficiently, reducing financial stress in the process.

If you are a homebuyer wishing to lower your mortgage rate or a car owner wanting to reduce auto payments, Ainee is here to help. Our promise to provide tailored refinancing advice enables you to control your financial future and get substantial savings from the best refinance loan options available. With Ainee, your route to financial peace is personalized and clear.

Conclusion

Explore refinance loan options to unlock savings and boost your financial future. We went over different refinance loans, benefits of refinancing, and tips for finding the best refinance rates. Learning about eligibility, costs, and the refinancing process matters for smart decisions.

With the info on refinance loan options, review your mortgage, set your goals, and compare lenders to find the best fit. Every choice now can lead to better financial freedom for you later. Don't miss out on these chances to secure a bright future.

Using the insights here, you can save more and pick a refinancing plan suited to you. Take the time to explore refinance loan options. Start your financial journey today and take charge of your finances!

About Ainee

Ainee is a dedicated personal financial advisory platform that specializes in refinancing solutions for mortgages and vehicle loans, providing users with personalized guidance and insights based on their financial situations.

By helping individuals save money on loan payments through lower interest rates, Ainee plays a crucial role in promoting financial wellness and informed decision-making. Start your journey towards smarter financial choices today and explore how Ainee can help you by visiting ainee.com.