Refinance

How to Refinance Your Mortgage Loan in 5 Easy Steps

Nov 27, 2024

How to Refinance Your Mortgage Loan in 5 Easy Steps

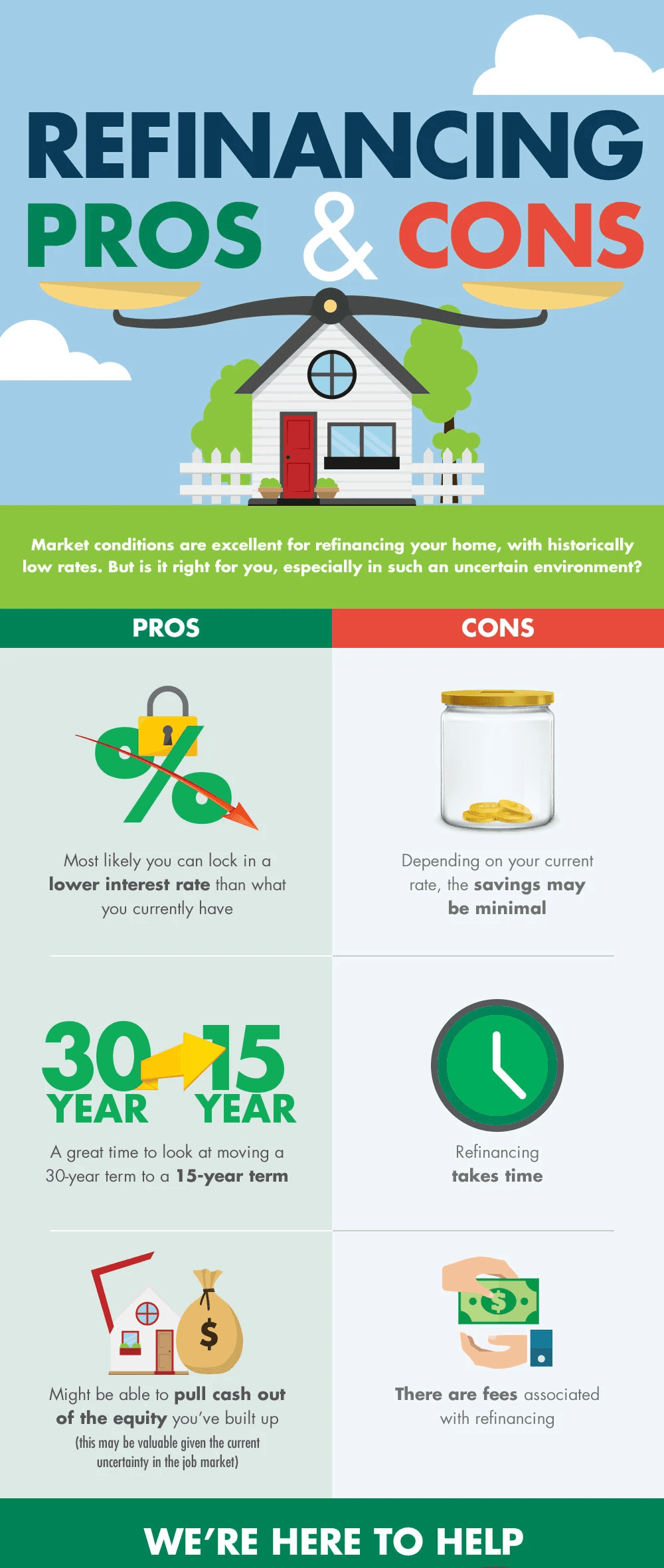

Thinking about refinancing mortgage loans? You’re in the right place. Many homeowners feel unsure about this decision. Refinancing help to reduce monthly payments, tap into home equity, or get a more attractive rate. With clear steps, navigating this can be easier.

We will cover key steps to guide you. From setting refinancing goals to sealing the deal, each step is vital. You will know how to review your credit score, prepare documents, and compare rates. Each action is important for successful refinancing activities.

Now let’s explore refinancing mortgage loans and discover how much you can save. Understanding trends and options is key, and ready information can help in every decision you make.

Step 1: Determine Your Refinancing Goals

Before you start refinancing mortgage loans, outline your aims. Defining your reasons for refinancing helps you focus on results. Your key aims can range from lowering payments, reducing loan length, or using home equity for cash.

Lower monthly payments are a major reason homeowners choose to refinance. Current historically low interest rates give homeowners the chance to shift to a lower-rate mortgage. Many can save hundreds every month, with these amounts growing over the loan duration.

Another common goal when refinancing is reducing your loan term. Switching from a 30-year to a 15-year mortgage allows quicker loan repayment, fast equity builds. This choice may raise monthly payments but can offer savings that lead to debt freedom sooner.

Home equity access motivates owners to refinance too. Whether it’s for fixing your home, merging debts, or education costs, this method can supply needed cash without high-interest loans. Be cautious of increasing debts, so always consider your finances.

If you’re paying private mortgage insurance due to a down payment under 20%, refinancing might help remove this cost. If home values have increased or you've paid down debt, striking 20% equity can cut expenses and improve finances.

The perks of refinancing mortgage loans go beyond immediate savings. Knowing your motivations helps craft a refinancing strategy that fits long-term aims. Consulting financial experts provides tailored refinancing solutions. Clear refinancing goals create a foundation for success.

Once your refinancing goals are clear, check your credit score. A good credit score often means better loan rates and terms, so know where you’re at to negotiate better refinancing options.

Step 2: Check Your Credit Score

Check your credit score before starting the refinancing mortgage loans process. This score is key in shaping lenders’ offers. A good credit score increases your chances of lower rates and better terms. Secure rates with a strong score.

First, review your credit reports from the main bureaus. It’s wise to get all three reports. Errors can hurt your refinancing chances. According to the Fair Credit Reporting Act, you can get one free credit report yearly from Experian, TransUnion, and Equifax.

Aim for 740 or above. This score opens the door to the best mortgage rates. If it’s lower, expect higher rates. These costs can add thousands to your loan over time.

If your score isn’t great, take steps to boost it. Pay off debts, pay bills on time, and cut down on credit use. Waiting a few months after these steps can help your score rise before you refinance.

In summary, checking your credit score is vital for refinancing mortgage loans. It shows your financial health and helps you make smart choices. Understand your score, and you prepare for the refinancing journey ahead.

After setting your refinancing goals and knowing your credit score, the next move is to gather documents for your refinancing path.

Step 3: Gather Necessary Documentation

After checking your credit score, it's time to gather documentation for refinancing mortgage loans. Having the right paperwork ready will help speed up approval times in the refinancing process.

First, compile crucial documents that lenders need. This includes your recent W-2 forms, two years' tax returns, and the last two months of bank statements. These will give a clear view of your income and spending behavior.

Also, you need proof of homeowners insurance. Lenders ask for this to ensure the property is protected. If you have an escrow account, any related documents can be helpful as well.

Prepare a list of your current debts and liabilities. Lenders want to see how existing debts impact your ability to repay the new loan. This list includes car loans, student loans, credit card debts, and any other obligations.

Recent trends show that platforms like Ainee can simplify the document collection process. They connect financial accounts directly to gather the needed information quickly. This tech can reduce the hassle of this step.

Finally, having all documentation accurate and ready helps create a smoother refinancing experience. Once you've gathered these essentials, you’s ready to compare rates next.

Step 4: Shop for the Best Refinance Rates

After you’ve gathered all the needed documentation from Step 3, it’s time to look for the best refinancing mortgage loans. A small change in your interest rate could create large savings across the lifetime of your loan, so it matters to do thorough research.

Begin by approaching several lenders to get quotes and Loan Estimates. Aim to gather offers from at least three different lenders. This way you can evaluate the interest rates along with the various terms linked with each offer. A lower interest might have larger fees, so examin the total refinancing cost.

While looking at lenders, review the Loan Estimates closely. These include more than rates, they also contain origination fees, appraisal costs, plus other closing costs. These charges can accumulate fast and influence your overall savings. Ask about hidden charges that other lenders may not clearly state.

A refinance calculator can assist you in this task. It lets you calculate possible savings and find your break-even point. This point is when your monthly saving will exceed your refinancing costs. It’s helpfull for visualizing how many months it will take for the refinance to benefit you.

Also consider customer service and the lender’s reputation. A low rate won’t service you well if the lender is hard to engage with during the refinancing. Look for online reviews or ask friends for advice to pick lenders recognized for their service and honesty.

By carefully evaluating lenders and their offers, you'll put yourself in an excellent position to gain a refinance rate that works best in your favor. This lays a strong base for completing the refinancing process.

With the prime refinance rates obtained, you're all set for Step 5: Close Your Refinance Loan, where you wrap up all arrangements and start enjoying your new mortgage conditions.

Step 5: Close Your Refinance Loan

After selecting a lender and locking in your refinance rate, closing begins. This is vital step. You must understand what’s required and what happens next.

Before the closing meeting, you will get a document named the Closing Disclosure. This outlines the final terms of your mortgage loans, like interest rate, payments, and loan amount. It also details closing costs. Review it carefully to ensure it matches what you initially agreed with your lender. Contact your lender with questions or if there are discrepancies.

Closing costs usually range from 2% to 6% of your loan total. This depends on fees, location, and other costs. You need to prepare to pay these upfront or negotiate to add them to the new mortgage loans. Knowing these costs helps to avoid surprises during closing.

Closing your refinancing mortgage loans is a big milestone. It marks the end of one journey and the start of a new financial chapter. Understanding your obligations moving forward is vital as it sets the stage for the benefits refinancing offers.

Conclusion

Refinancing mortgage loans can be simple if you follow the right steps. This guide outlined five steps: first, identify your reasons for refinancing to shape your strategy. Next, check your credit score to see where you stand financially, before gathering necessary documents to make everything easier.

Look for the best rates on refinancing mortgages to find the best deals. Lastly, confidently close your loan. Key points are about planning, knowing your finances, and comparing alternatives. You can save both time and money by doing this.

With this information in hand, it's time to move forward. Look at your current mortgage and define your refinancing aims right now. Choosing to refinance might reduce your monthly bills or help you get a better rate, which helps strengthen your finances. Take the step to refinance mortgage loans and enhance your economic outlook!

About Ainee

Ainee is a personal financial advisory platform that specializes in refinancing solutions for mortgages and vehicle loans, offering users personalized guidance to optimize their financial decisions.

Discover how you can save money on loan payments by exploring tailored refinancing options—visit ainee.com today to get started!