Financial Advisor

Refinance

Understanding the Core Duties of a Financial Advisor

Nov 23, 2024

Understanding the Core Duties of a Financial Advisor

To build a secure financial future, know the financial advisor duties and responsibilities. Understanding these duties is key. Financial advisors guide clients through complex financial choices. This blog gives insight into what you might expect from these professionals.

This article looks at the key responsibilities in a financial advisor's role. These range from managing client relationships to creating customized financial plans and developing investment strategies. By knowing the duties of a financial advisor, you can see how they can help your financial goals. This knowledge will aid in you engaging your advisor efficiently, ensuring your goals get met professionally.

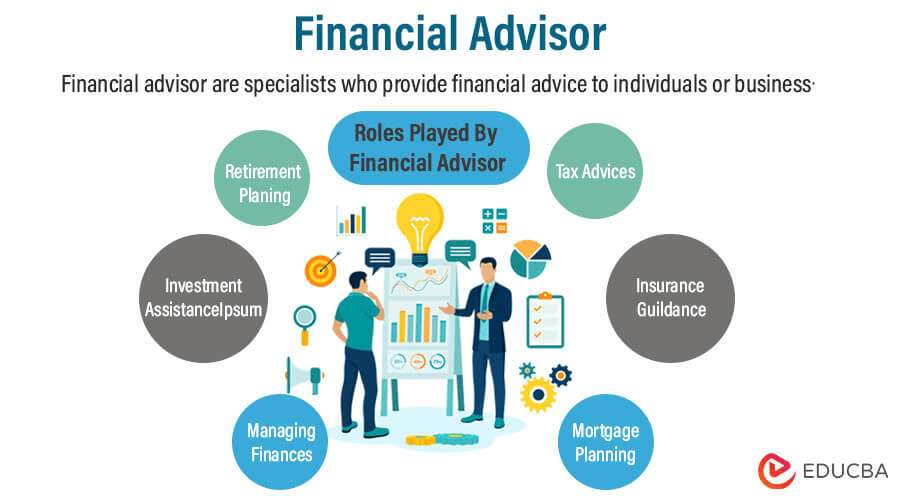

Overview of Financial Advisor Duties and Responsibilities

Financial advisors help people and businesses achieve their monetary goals. Their duties cover a wide range of tasks that need a solid understanding of clients’ financial needs, personalized advice, and planning strategies.

A key financial advisor duty is to perform thorough assessments of a client's financial condition. This includes looking closely at current finances, income, expenses, and future financial aims. Advisors gives tailored advice that matches their clients' goals, like saving for retirement or paying education.

Investment advising is another major responsibility. Financial advisors keep up with market trends and different investment options. They must guide on stocks, bonds, mutual funds, and other investments. They also consider personal factors, such as risk tolerance and investment time frame. These aspects are important for choosing appropriate investments.

Crafting personalized financial plans is essential in a financial advisor’s job. This means creating a strategy that combines budgeting, saving, and investments tailored for each person or business. Advisors work closely with clients to execute these plans, adjusting as needed based on financial changes or market shifts.

In conclusion, the duties and responsibilities of a financial advisor are diverse and essential for proper financial management. Financial advisors give customized support, investment guidance, and comprehensive financial plan development. This helps clients manage personal finance complexities effectively.

Next, we will explore the common responsibilities that shape the work of financial advisors, emphasizing key tasks crucial for daily operations.

Common Financial Advisor Duties and Responsibilities

Grasping the specific financial advisor duties and responsibilities helps aspiring professionals and clients. Advisors assist clients in reaching their financial goals. A key duty is to understand clients’ goals. This involves thorough assessment of aspirations, risk levels, and finances. Such understanding aids in crafting customized strategies that fit client objectives.

Another major duty is to teach clients how to make informed decisions. This part is vital as it helps clients see the reasons behind advice and choices, giving them confidence in finance management. Educating clients is important for their growth.

Advisors monitor client portfolios. Ongoing advice is another main responsibility of a financial advisor. This includes regular reviews of investment performance, observing market trends, and essential adjustments for achieving goals. They use metrics and market data for accurate advice.

These duties foster trust between the advisor and clients. They also equip clients for their financial paths. Knowing the common financial advisor responsibilities sets the stage for exploring client interaction and relationship management. This dynamic is crucial for successful advisor-client relationships.

Client Interaction and Relationship Management

A key part of the financial advisor duties and responsibilities is to build and sustain trust with clients. This trust supports a productive advisor-client bond. It's vital for sound financial management. Advisors handle sensitive information, so creating a secure space is essential. Providing expertise, remaining transparent, and caring about a client’s finances helps build this trust.

Open communication is very important in managing client relationships. Financial advisors must stay accessible and ensure that discussions happen freely. They should be proactive in informing clients about shifts in the financial world, investment performance updates, and respond quickly to questions. Advisors have to regularly assess client goals and risk tolerance for mutual understanding.

Regular updates and meetings form the core of ongoing bonds. These exchanges should focus on not just immediate financial issues but also long-term goals and strategies. Having check-ins through in-person chats, video calls, or phone calls assures clients they're valued. Continual engagement helps advisors refine approaches as clients’ needs change, which is essential due to shifting markets.

As the economic environment shifts, maintaining contact allows advisors to suggest growth and investment opportunities reflecting client goals. By prioritizing client interaction and relationship management, financial advisors reinforce their role as dependable allies in client success.

With established trust and effective communication, advisors can move toward developing customized financial plans. This leads into financial planning and strategy, covering how advisors assist clients in meeting their aspirations.

Financial Planning and Strategy

Among the financial advisor duties and responsibilities, one key role is financial planning and strategy. This involves helping clients achieve financial goals through personalized guidance and detailed plans.

Effective financial planning relies on comprehensive financial assessments. Advisors study clients’ income, expenses, investments, and debts. This detailed view helps them spot strengths and weaknesses, enabling them to create tailored solutions.

Setting financial goals is also important. Advisors collaborate with clients to establish both short and long-term aims. Whether it’s saving for retirement or buying a home, it’s crucial for advisors to help clients clarify and prioritize their objectives.

After setting goals, advisors create tailored strategies that reflect clients’ risk tolerances. Each client’s comfort level with risk can differ. So advisors develop savings and investment strategies that match these preferences, ensuring a balance between potential gains and acceptable risk.

In conclusion, financial planning and strategy are central to a financial advisor’s responsibilities. Through careful assessments, effective goal-setting, and understanding clients’ risk profiles, advisors design strategies that guide clients toward their aspirations. As we move to investment management duties, it's important to see how these strategies impact portfolio choices.

Investment Management Duties

Investment management duties are a key part of financial advisor duties and responsibilities. They help clients reach financial goals. Advisors mitigate risk with personalized investment strategies.

One main responsibility involves creating tailored investment strategies. These align with financial goals, risk appetite, and market status. A strong grasp of assets like stocks, bonds, and alternatives is needed. Staying updated with market shifts also aids in giving sound advice.

Regularly reviewing clients' portfolio performance is vital. Advisors analyze investments closely, ensuring they meet performance goals. This ongoing evaluation shows if clients reach targets or require adjustments due to market changes or personal shifts.

Rebalancing the portfolio when necessary is an important duty. A financial advisor ensures a balanced portfolio according to the client's strategy. Making decisions to buy or sell keeps risk managed and enhances return potential.

Through these investment strategies, advisors help clients manage investments effectively. They ensure the portfolios align strategically to foster long-term success in their goals.

Moreover, compliance and ethical standards are critical. They influence financial advisor responsibilities and ensure clients receive reliable service.

Compliance and Ethical Standards

Financial advisor duties and responsibilities include managing investments while adhering to compliance and ethical standards. These standards guide advisors actions. They protect clients, ensuring their welfare is prioritized. Compliance with regulations from bodies like the SEC and FINRA is mandatory.

The fiduciary duty forms a core part of their responsibilities. Financial advisors must act in the best interest of clients. Their own financial needs cannot come first. Choices made must reflect client objectives. This builds trust and responsibility in advisor-client relationships.

Transparency is also important in these relationships. Advisors need to communicate clearly about fees and any conflicts of interest. Clients deserve to understand costs thoroughly. This knowledge helps them make informed decisions regarding their investments and the broader strategy.

In summary, financial advisor duties and responsibilities encompass regulatory compliance, fiduciary duty, and transparency. Adhering to these ethical standards maintains the integrity of the profession and protects investors from risks and misconduct.

Beyond compliance and ethics, ongoing education is crucial for financial advisors. The financial sector changes often, meaning advisors need to stay current in their knowledge and skills.

Professional Development for Financial Advisors

A financial advisor duties and responsibilities involves ongoing learning. The financial landscape changes quickly. Advisors must focus on professional growth. This is crucial for meeting client needs effectively. Continuous education keeps advisors competitive. They provide better service.

Advanced certifications matter in this field. For instance, the Certified Financial Planner (CFP) certification boosts credibility. It equips advisors with skills to serve diverse financial needs. This also shows a commitment to ethical practices. Clients tend to trust CFP-certified advisors more, enhancing relationships.

Staying informed about industry trends is essential too. Financial advisors should pursue workshops, seminars, and online courses. These avenues offer insight into new financial products, regulations, and market changes. Engaging in these activities allows advisors to refine their strategies effectively.

Soft skills matter as well. Financial advisor duties and responsibilities include strong communication skills. Understanding clients is vital for relationship building. Therefore, professional development should cover both technical and interpersonal skills. In conclusion, ongoing education supports a successful financial advising career.

The significance of professional development is large. Financial advisors can navigate tax planning and estate management duties effectively. These areas often need precise attention. Staying current is critical to fulfill responsibilities.

Tax Planning and Estate Management Duties

Tax planning and estate management are important duties of a financial advisor. They help clients create tax strategies based on their financial situations and aims. This means understanding different tax laws and informing clients about tax-efficient investments.

A primary responsibility is to guide clients in estate planning. Advisors support clients in defining their estate plans. This includes selecting beneficiaries, deciding asset allocation, and setting up necessary trusts. Proper estate planning helps transfer wealth easily and lowers taxes on heirs, preserving wealth.

Reducing tax burdens is another focus for financial advisors. They use strategies like tax-loss harvesting or timing asset sales to optimize client returns after taxes. By offering detailed analyses and specific recommendations, advisors help clients navigate tax challenges and enhance financial results.

Conclusion

In conclusion, knowing the key financial advisor duties and responsibilities is crucial. This applies to both future advisors and clients looking for advice. We discussed several roles. These include managing investments, maintaining client relationships, adhering to compliance, and focusing on financial planning and tax management.

With a clear view of financial advisor duties and responsibilities you can now take steps. Clients should find advisors that match these important responsibilities. This will help ensure you meet your financial targets. For professionals, think about ways to improve your skillset in these areas.

Understanding these insights not only helps you it also builds a good relationship with a financial advisor. Whether you handle finances personally or assist clients, knowing these duties is a vital step for achieving your financial goals.

About Ainee

Ainee is a personal financial advisory platform that specializes in providing refinancing solutions for mortgages and vehicle loans, offering tailored insights and guidance based on your unique financial situation.

By helping individuals save money on loan payments through lower interest rates, Ainee is dedicated to empowering users to make informed financial decisions and achieve their financial goals. Discover how Ainee can help you save today!