Vehicle Loan

Financial Advisor

Pro Tips

Key Questions About Using Auto Loan Calculators for Extra Payments

2024/12/04

Wonder how an auto loan calculator can help with extra payments and save on your vehicle loan? Using an auto loan calculator pay extra can change how you understand the effects of extra payments on your total loan balance. If you want to refinance your vehicle loan or check how to pay it off quicker, this guide aids with key question.

In this post, we’ll look at benefits of making extra payments, show how much you save, and give tips on vehicle loan refinancing. We’ll explain principal-only payments and how they fit in with the auto loan calculator. By the end, you’ll understand using these calculators has advantages and know strategies for reaching your goals—leading you closer to financial freedom.

Using an Auto Loan Calculator Effectively

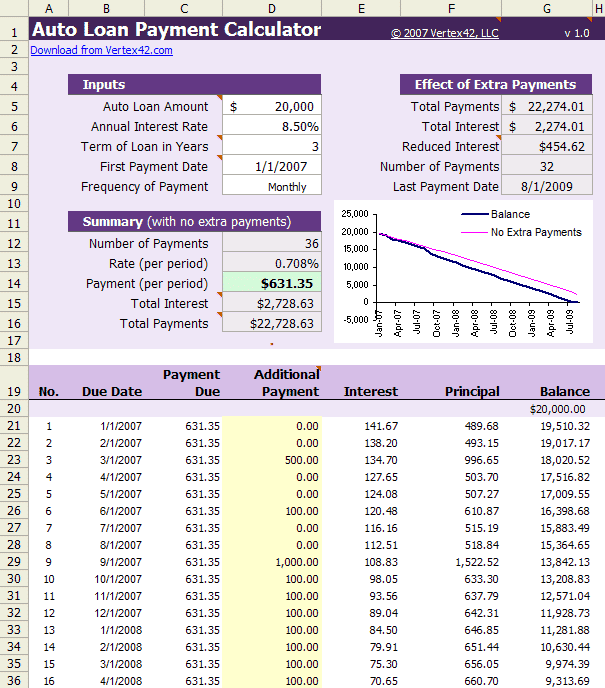

To use an auto loan calculator pay extra, you need precise info. Start with your current loan amount, interest rate, and loan term. These data points help the calculator give a clear view of your monthly payments.

After entering the basic info, check the impacts of extra payments. Auto loan calculators have a section for "extra payment" where you can say how much extra you want to pay monthly or in one go. This is very important since it shows how added payments can lower overall interest and shorten your loan term significantly. For example, a $100 extra payment could save you thousands in interest.

Look at how extra payments change both total loan costs and the payoff date. The calculator shows a new amortization schedule with reduced balance and the new estimated payoff date. This info helps you decide if you want to keep your original plan or add more money toward the loan.

Using an auto loan calculator offers insight into your current loan payment details and compares various loan choices along with refinancing options. By putting in different interest rates and amounts, you can see how new terms could shape your finances. If considering vehicle loan refinancing or ways to manage payments better, using tools like these helps visualize your finances.

In the next section, we will cover how making extra payments can improve your financial health and save you money on your vehicle loan.

Benefits of Making Extra Payments

Making extra payments on your vehicle loan can give you several financial benefits. These can help you save money in the long run. A key advantage is lower interest costs. Each extra payment lowers the principal, leading to less interest charged throughout the loan. About 60% of total interest on automotive loans occurs in the first half of the term. Extra payments at the start help minimize these costs.

Besides cutting interest, making extra payments can quicken your loan payoff date. Auto loans require set monthly payments, mainly covering interest initially. Contributing extra funds can speed up the principal's decline, shortening your overall loan time. Borrowers can pay off their loans up to four years sooner with a few extra payments yearly.

The long-term effects of making extra payments are great. Paying down principal fast cuts overall interest costs too. So, you could save thousands over the loan’s life. This savings can redirect to other key financial goals like investing or saving for a home. Thus, using an auto loan calculator pay extra can enhance your finances.

Extra payments lead to reduced financial burdens alongside a clearer route to financial freedom. Now that we know these benefits, let’s see how much you can really save with these methods.

How Much Can You Save with Extra Payments?

Saving with extra payments on vehicle loan requires knowing several factors. The interest rate matters, and so does the timing of these payments. Extra payments to the principal may decrease your total interest paid and help you pay off the loan faster.

Looking at some scenarios can show the savings potential. A $20,000 auto loan at 5% over 60 months has about $377 for the monthly payment. If you pay an additional $100 monthly, it may save around $1,600 in interest, paying off the loan 17 months earlier. Even a $1,000 one-time extra payment early on could save $200 interest, showing timing's importance.

Using an auto loan calculator pay extra helps estimate potential savings effectively. Input your loan details and extra payments, to see savings in interest and time clearly. This insight aids borrowers in deciding repayment strategies based on their situation.

Understanding savings possible from extra payments influences your financial choices about your auto loan. With this knowledge, let's also look into vehicle loan refinancing options, which can be key in managing your auto loan efficiently.

Vehicle Loan Refinancing Options

Vehicle loan refinancing lets you get a new loan to clear an existing auto loan. This often brings lower interest rates, a better loan term, or a new lender. One key benefit is saving money monthly and reducing total interest across the loan's lifespan.

First step in refinancing is to look at your current loan terms. Next, compare them with new loan offers. This includes looking at rates, fees, and loan costs. An auto loan calculator helps to see how rates and terms impact monthly payments, especially if you wanna pay extra.

After you get potential loan offers, calculate savings from refinancing. It helps to see monthly payments against total interest if you switch loans. If refinancing cuts costs, even after fees, it may be worth looking into.

Refinancing often suits borrowers when interest rates fall below what they pay now. If your credit score improved, you might find better terms. It can help if you're having trouble making payments too. Extending the loan term may provide lower monthly costs.

Therefore, vehicle loan refinancing can offer chances for borrowers to improve their finances, but it needs careful planning.

As we look at payments directed toward principal, note how they fit in with refinancing plans. Making payments toward principal helps reduce the loan's total cost.

Understanding Principal-Only Payments

Principal-only payments are the extra amounts you pay on top of standard auto loan payments. They directly cut the loan's principal balance. These payments do not include interest; they strictly focus on reducing principal. This helps minimize total interest paid on the loan.

Making principal-only payments has a significant impact. Paying down the principal quickly reduces how much interest builds up over time. Since interest is based on the current balance, paying down early can significantly cut overall costs. For those in vehicle loan refinancing, knowing how these payments work is very important.

Before making principal-only payments, talk to your lender. Not every lender applies extra payments directly to principal. They might treat them differently. Understanding your lender's payment application policies ensures you maximize savings. Check the terms with your auto loan calculator pay extra to see how these payments will affect your overall loan.

Conclusion

Using an auto loan calculator is a powerful way to understand how extra payments can reshape your financial plan. We've explored the best strategies for utilizing these calculators, examined the advantages of making additional payments, and considered the opportunities presented by vehicle loan refinancing. Knowing the difference between standard and principal-only payments can also unlock significant savings.

Taking control of your auto loan by making extra payments can save you substantial interest and shorten your loan term, paving the way to greater financial flexibility. The earlier you start, the more benefits you'll reap.

When armed with the right tools and information, smart financial decisions become simpler. Your journey toward a more manageable and rewarding auto loan experience begins with the choices you make today.

If you’ve struggled with confusing auto loan calculators, Ainee offers a free, user-friendly, and intuitive solution. Let Ainee guide you toward smarter financial decisions with ease and confidence. Try it now and take the first step toward financial empowerment!

About Ainee

Ainee is a personal financial advisory platform that specializes in providing refinancing solutions for mortgages and vehicle loans, helping users make informed financial decisions.

It matters because Ainee helps individuals save money on loan payments by presenting tailored refinancing options that connect them with lower interest rates and expert advice. Start your journey towards smarter financial decisions by downloading the Ainee App today!