Vehicle Loan

Financial Advisor

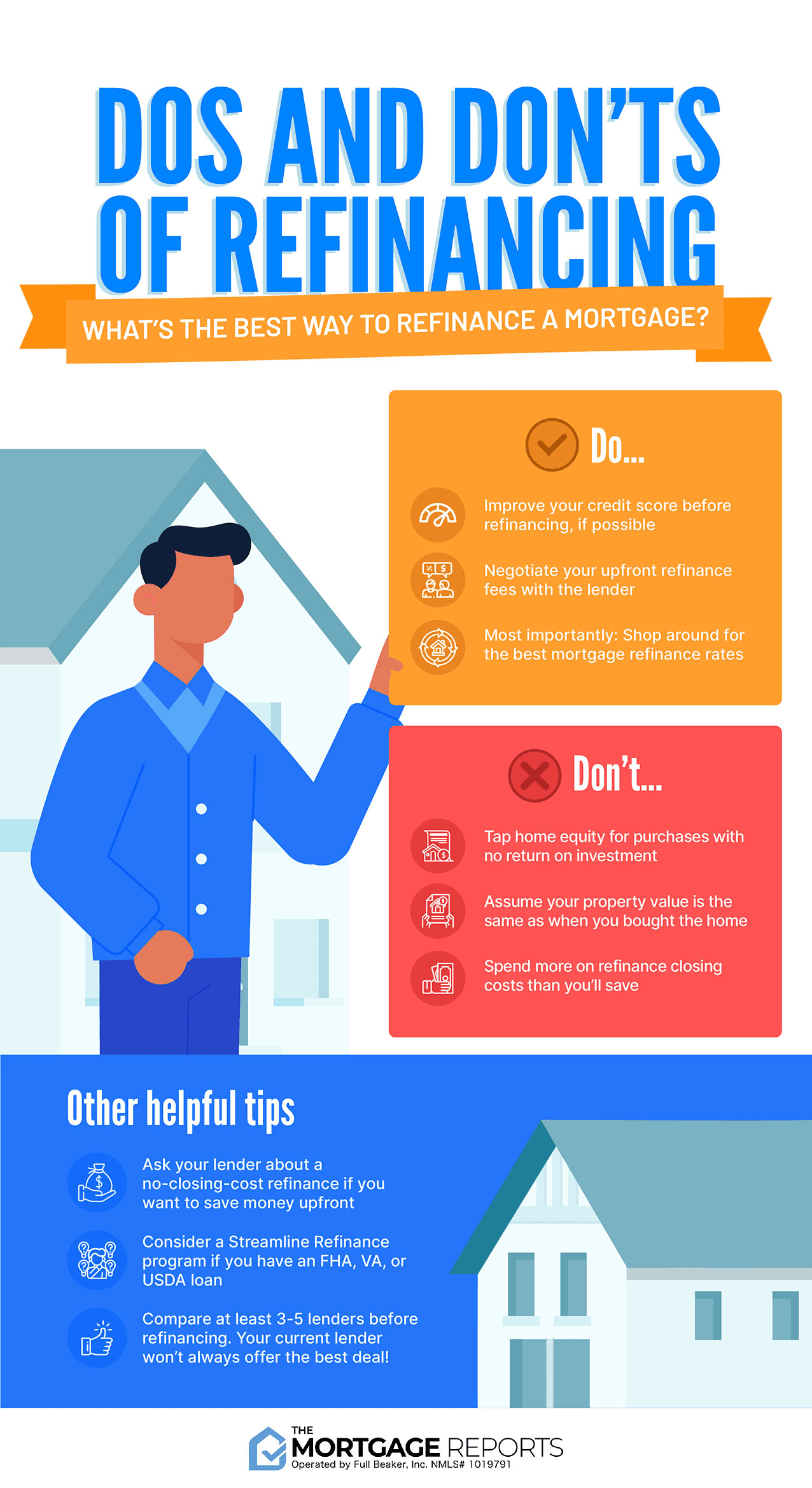

What Are the Most Effective Mortgage Refinancing Tips?

2024/12/12

Making smart financial choices demand careful consideration of mortgage refinancing tips. If your aim is to decrease monthly bills, tap into home equity or get a better rate, refinancing can be wise decision. But, refinancing process can feels overwhelming without clear advice.

This useful guide serves key strategies. You will learn ways to boost savings and make informed decisions. Start by clarifying your reasons for refinancing. Next, check your credit score. It's also important to understand loan varieties and analyze closing costs.

By this articles end, you will have tools to refinance your mortgage effectively. You will be ready to reach your financial objectives. Let’s explore tips to help you manage your home loan and your financial situation.

Determine Your Reason For Refinancing

Before starting the mortgage refinancing process, know clearly why you are doing it. Are you looking for lower payments? Maybe you want to access home equity or remove private mortgage insurance (PMI). Knowing your reasons shapes the strategy you take. Each goal has its own aspects to think about.

If lowering your monthly payments is the goal, look into loans with lower interest rates or even lengthening the loan term. If accessing home equity interests you, cash-out refinancing lets you turn equity into cash that can fulfill other financial requirements.

Removing PMI can matter too, particularly if your loan initially needed this insurance due to a down payment under 20%. Refinancing to a loan with at least 20% equity might help you drop this cost thus lessening your monthly bills.

Grasping your motivation helps to focus your options and lets you make informed decisions. With defined goals, you can move on to the next step: checking your credit score. This step is key in securing the best mortgage refinancing tips.

Check Your Credit Score

Your credit score is key to your refinancing options. A score above 740 is best and it helps you find good refinancing terms. Scores under 620 can limit your choices and may lead to higher rates. Know your score before you start the refinancing process.

Checking your credit report is smart. Many people have found errors in their reports. About 20% of consumers face this issue. Mistakes on your report can hurt your score, limiting your refinancing options. Fixing errors may lead to better interest rates.

If your score isn't good, think about ways to raise it before refinancing. You can pay down debts and make on-time payments. Avoiding new credit applications is smart too. Even small improvements can save you money on your loan, which shows why checking your score is important.

Knowing your credit score is essential for mortgage refinancing. It impacts not just your eligibility but also your financial plans for the future. After you check and enhance your score, you can better figure out your home equity, which is a next step in refinancing.

Estimate Your Home Equity

Knowing your home equity is important when looking for mortgage refinancing tips, especially if you think about cash-out refinancing. Home equity is what you own in your home. To find it, subtract your mortgage balance from the current market value. For example, if your home is worth $300,000 and you owe $200,000, your equity is $100,000.

This equity can help you access cash, consolidate your debts, or fund home projects. Different refinancing strategies say that homeowners can sometimes leverage up to 80% of their equity. Therefore, knowing your equity helps you make better decisions on borrowing and refinancing.

Every financial choice carry risks, so you must think about how equity affects your budget and future goals. If your plan is to use this to clear debts or make big buys, consider the long-term impacts it may have on your home's value.

Determining your home equity is vital, yet you should also know the closing costs linked with refinancing. Knowing these costs gives a fuller picture of your financial status as you decide on refinancing options.

Be Aware of Closing Costs

When you think about mortgage refinancing, one main thing often gets missed is closing costs. They can greatly change the advantages of refinancing, so being prepare is key.

Get ready for the many closing costs you might face during refinancing. You’ll usually need to pay for appraisal fees. This pays for finding your home's current value. Then there’s title insurance fees. They protect against loss due to title issues. Also include application fees for the costs of refinancing applications. Knowing these costs help you budget and creates better plan.

For refinancing, closing costs commonly vary between 3% to 6% of your new loan amount. For instance, if you're refinancing a $300,000 mortgage, expect to see costs from $9,000 to $18,000. Evaluating if savings from refinancing exceeds these amounts is really important.

Some lenders may offer options to refinance with no closing costs. Check these options closely, as they can sometimes come with higher interest rates or terms that might make savings less. Knowing all about closing costs lets you make better decisions while refinancing.

As you consider the costs, understanding loan types matter too. This helps you find the right choice for your needs related to your refinancing goals.

Learn About Loan Types When Refinancing

When you think about mortgage refinancing tips, knowing the kinds of loans available is important. It helps you choose what fits your finances. Here are the main refinancing types you should look at:

1. Rate-and-Term Refinance: This way, homeowners can change their interest rate or the loan’s term without taking cash out. It helps to reduce monthly payments or pay off the loan more quickly. A lower rate can result in bigger savings on interest over time. Adjusting term helps manage repayments to fit your situation.

2. Cash-Out Refinance: This choice works for those pulling equity from their home. Homeowners borrow more than what they owe now, getting the extra in cash. It’s useful for home updates, paying bills, or education. However, this increases the loan amount, needing careful management to avoid financial stress.

3. Streamline Refinance: This option makes life easier and is generally for those with VA, FHA, or USDA loans. Streamline refinancing reduces the usual work needed for traditional refinancing, allowing faster approvals with less paperwork. This serves those wanting lower rates freely.

Grasping these refinancing paths helps you maneuver through mortgage refinancing tips. Plus, it arms you with info to find the best fit for your needs.

As you consider your options, don’t forget to research the best rates to take advantage of your refinancing.

Seek the Best Rates

One crucial mortgage refinancing tips is seeking the best rates from several lenders. Different lenders usually have different deals on interest rates and loan terms. This choice significantly affects your long-term financial goals. Compare offers to find favorable terms that match your refinancing needs.

When you're looking at lenders, check their interest rates, terms, and all fees related to refinancing. Focus on lenders with good rates and positive customer feedback. Those lenders often provide clear pricing, which helps avoid surprises during the refinancing process.

Comparison tools are useful. They give you a side-by-side view of rates. Using a mortgage broker can also be smart, as they have access to many lending options. A tiny difference in interest can lead to major savings over time.

Also, examine the APR. It shows more than just the interest rate; it includes total borrowing cost for the loan. A lower APR usually means a better deal that accounts for fees and other costs.

Remember that lenders have specific rules about who qualifies and their rates. Prepare all required documents in advance. Having your financial information ready helps you show lenders a complete picture and improves chances for a good rate.

Having different offers lets you negotiate better. This ensures you get the best rate and deal possible. As you continue with your refinancing, the next step is getting your paperwork ready. Staying organized is key for smooth refinancing.

Gather Necessary Documentation

After weighing the benefits of mortgage refinancing tips and looking for best rates, it’s time to collect the needed paperwork. Proper papers are very important, since they help lenders process your refinancing application quick and smooth.

Begin by getting key documents. These usually involve recent bank statements, tax returns, and W-2s from your job. Having clear details about your current mortgage balance and payment history can help with your application. Some lenders require info on extra debts as they impact your debt-to-income ratio.

Organizing your refinance documents fast can speed up the refinancing process. Consider using a folder to keep everything in one place. Having the right info ready helps you make a good impression on lenders. It’s important to be organized.

After sorting your documents, you are ready to move to the next step in the refinance journey – locking in your interest rate. A proper arrangement of your paperwork can make your experience smoother and help you find the best rates for a new mortgage.

Lock in Your Interest Rate

Locking in your interest rate when refinancing mortgage is key to get good terms for the new loan. This protects you from sudden interest rate changes before your refinance is complete. Homeowners can gain a lot from locking in low rates right now.

When you lock in the interest rate, you choose a specific rate for a set time. This usually ranges from 30 to 60 days. It acts like an insurance policy. You gain assurance that shifts in market conditions won’t hurt your refinance. The Federal Reserve or market changes may occur. You stay safe from potential hikes.

Many borrowers often miss out on locking rates. This happen because they do not recognize the fast changes in the market. For case, the mortgage market can pivot quickly due to announcements or political changes. By locking your rate, you avoid this uncertainty, boosting your confidence in refinancing.

You need to pay attention to important details when locking your interest rate. It’s crucial to know how long the lock lasts and what occur if your closing takes longer. If your lock expires before closing, you might have to negotiate a new rate. This new rate could be worse than your previous one.

With today’s lending conditions where rates can shift greatly, using an interest rate lock is one of the best mortgage refinancing tips. It can boost your savings across the entire loan life. Ensure to talk with your lender to fully understand the locking process, duration, and any fees involved. This is must to help in evaluating your financial goals prior to refinancing.

Evaluate Financial Goals Before Refinancing

Before refinancing, review your financial goals. This process starts with talking to a financial advisor. They're can help you determine if refinancing meets your long or short-term objectives. If your goal be to reduce high-interest debt, refinancing your mortgage could free up cash.

Think about how refinancing might impact your finances. Lots of homeowners refinance to get lower monthly mortgage payments. These lower payments might provide room for new investments or other expenses, like home repairs or educational fees. Yet, extending a loan’s term may lead to additional long-term financial issues.

To find potential savings in refinancing is crucial. Cutting a significant interest rate can lead to huge savings over the mortgage life. But, you should examine closing costs and other fees too. Calculate the break-even point, which indicates when your savings will outpace your refinancing costs. If you're staying beyond this point, refinancing could be wise.

In summary, evaluating financial goals before refinancing isn’t only about the numbers; it’s important understand your whole financial situation. If you target debt reduction, create better cash flow, or upgrade your home, make sure refinancing aligns with these goals to achieve better financial results.

Conclusion

In conclusion, mortgage refinancing is an effective way to manage your finances if done correctly. Know your motives for refinancing. Check your credit score. Understand your home equity. Familiarize yourself with loan types and closing costs. This knowledge helps you make the right choices.

After learning these mortgage refinancing tips, start by assessing your financial goals. Reach out to lenders or financial consultants. They can assist through the process. Managing your mortgage refinancing today opens doors to better opportunities tomorrow.

Using these mortgage refinancing tips can help achieve financial stability and home ownership. Take this path with confidence and hope for the future!

About Ainee

Ainee is a personal financial advisory platform that specializes in providing tailored refinancing solutions for mortgages and vehicle loans, helping individuals make informed financial decisions.

With Ainee, you can unlock savings on your loan payments through lower interest rates and expert guidance. Start your journey to smarter savings today!